Did the Senate Pass a Bill to Eliminate Taxes on Tips? Unpacking the Truth

The question of whether the Senate has passed legislation to eliminate taxes on tips is a complex one, often fueled by misinformation and misunderstandings. The short answer is: no, the Senate has not passed a bill to completely eliminate taxes on tips. However, the topic is frequently debated, and several proposals have been introduced that aim to modify or reform the current tax system related to tipped income. This article will delve into the intricacies of this issue, exploring the current tax regulations, proposed legislation, and the ongoing debate surrounding the taxation of tips.

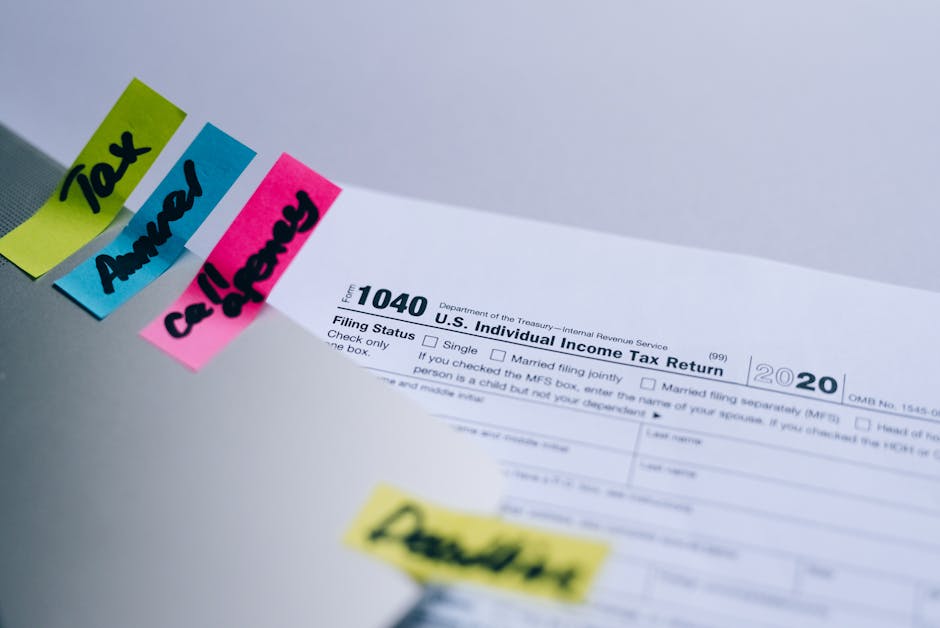

Understanding the Current Tax System on Tipped Income

In the United States, tips are considered taxable income. This means that employees who receive tips are responsible for reporting this income to the IRS. There are several ways this reporting occurs:

- Direct Reporting: Employees are required to report all tips they receive, regardless of whether they are reported to their employer.

- Employer Reporting: Employers often utilize a system where employees report their tips, and the employer includes this income on the employee’s W-2 form. This process helps ensure accurate tax reporting.

- Allocation of Tips: In establishments with tip pools or shared tipping systems, the allocation of tips among employees must be accurately documented and reported.

The failure to accurately report tipped income can result in significant penalties and legal consequences. The IRS has mechanisms in place to detect discrepancies between reported income and expected income based on industry standards and establishment type.

Proposed Legislation and the Debate Surrounding Tip Taxation

While no bill eliminating tip taxes has passed the Senate, various proposals have been introduced over the years that aim to reform the system. Some of these proposals focus on:

- Simplifying the reporting process: Some proposed legislation aims to streamline the reporting requirements for tipped employees, making it easier and less burdensome to comply with tax laws.

- Adjusting the tax rate for tipped income: Discussions have occurred regarding potentially adjusting the tax rate specifically applied to tipped income, potentially lowering the overall tax burden on these workers.

- Addressing the issue of tip credit: The current tip credit system, which allows employers to reduce their payroll taxes based on reported tips, is often debated. Some argue that it can lead to exploitation of workers and under-reporting of tips.

- Improving enforcement mechanisms: Some proposals focus on strengthening enforcement to address the issue of under-reporting of tips by both employees and employers.

The debate surrounding these proposals highlights the inherent complexities of the issue. Supporters of reform often argue that the current system is overly complicated, burdensome, and disproportionately affects low-wage workers who rely heavily on tips for their livelihood. They believe that simplification and potential tax rate adjustments could provide much-needed financial relief. Opponents, however, express concerns about the potential loss of tax revenue and the possibility of encouraging under-reporting.

The Role of the Senate and the Legislative Process

The Senate plays a crucial role in the legislative process for any proposed changes to the tax code, including those related to tip taxation. For a bill to become law, it must pass through both the House of Representatives and the Senate and then be signed into law by the President. Even if a bill successfully passes one chamber, it can face significant hurdles in the other, leading to delays or even defeat.

The legislative process is influenced by a variety of factors, including political considerations, economic forecasts, and public opinion. The complexities involved in reforming the tip taxation system, along with differing opinions on the best approach, often lead to prolonged debates and challenges in achieving consensus.

Misinformation and its Impact

The frequent appearance of misinformation online surrounding the topic of tip taxation underscores the importance of seeking accurate information from reliable sources. Social media and other online platforms can spread inaccurate claims, leading to confusion and a lack of understanding of the true state of affairs. It is crucial to consult official government websites, reputable news organizations, and tax professionals for accurate information on this topic.

Looking Ahead: The Future of Tip Taxation

The ongoing debate surrounding tip taxation suggests that this issue is likely to remain a topic of discussion and potential legislative action in the future. As economic conditions change and concerns about fairness and equity continue to arise, policymakers will likely revisit the current system and consider reforms that aim to balance the needs of workers, businesses, and the overall tax system. Staying informed about proposed legislation and developments in this area is crucial for understanding the potential impacts on individuals and the economy.

Resources for Further Information

For more detailed information on the taxation of tips, you can consult the following resources:

- Internal Revenue Service (IRS) website

- Relevant Congressional websites (e.g., Senate Finance Committee)

- Reputable financial news outlets

By understanding the complexities of the current system and the ongoing debate, individuals can better navigate the challenges and ensure they are complying with tax laws while advocating for fair and equitable policies.