No Tax on Tips Senate Bill: A Deep Dive into the Ongoing Debate

The debate surrounding the taxation of tips has been a long-standing one, with significant implications for both service industry workers and the government. Recently, several Senate bills have proposed eliminating or altering the taxation of tips, sparking considerable discussion and controversy. This article will delve into the complexities of this issue, examining the current tax system, the proposed changes, potential impacts, and the ongoing arguments for and against eliminating tip taxation.

The Current System: How are Tips Taxed Now?

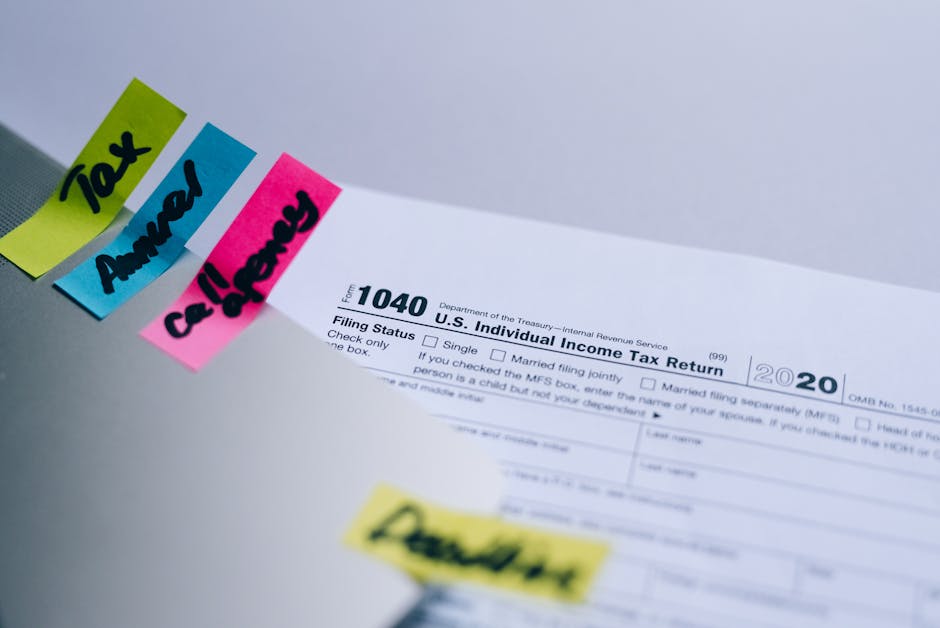

Currently, tips received by employees are considered taxable income by the Internal Revenue Service (IRS). This means that employees are responsible for reporting all tips received, regardless of whether they are reported by the employer or not. There are multiple ways tips are reported, adding complexity to the process.

- Employee Reporting: Employees are required to report all tips received, including cash and credit card tips, on their individual income tax returns. This often involves keeping meticulous records throughout the year.

- Employer Reporting: Employers are also involved in the process, often requiring employees to report tips received on a designated form. This reported information is used by the employer to ensure accurate reporting to relevant tax authorities.

- Charge Card and Credit Card Tips: These are generally more straightforward as they are directly tracked and reported by the payment processing system. However, discrepancies can still arise, requiring employees to reconcile their records.

- Allocated Tips: In some situations, particularly in establishments with shared tipping pools, tips may be allocated among employees based on set formulas or agreements. This can add another layer of complexity to the reporting process.

The current system often leads to difficulties in accurately tracking and reporting tips, frequently resulting in underreporting due to the challenges of record-keeping and the lack of clarity regarding the reporting process. This can lead to significant financial implications for both employees and the government.

Proposed Changes: What do the Senate Bills Propose?

Several bills proposed in the Senate aim to address these issues by significantly altering or eliminating the taxation of tips. These bills typically aim to simplify the tax reporting process, reduce the tax burden on service workers, and encourage more accurate reporting. However, the specifics vary significantly depending on the individual bill.

Some proposals advocate for a complete elimination of tip taxation, while others suggest implementing alternative systems, such as a flat tax rate on tips or a system that allows for a greater deduction for business expenses related to tip generation. These proposals highlight the diverse approaches being considered to address the challenges of taxing tips.

Arguments For and Against Eliminating Tip Tax

Arguments in Favor:

- Increased Employee Income: Removing tip taxation would result in a direct increase in the take-home pay for service industry workers, potentially boosting morale and improving their financial well-being.

- Simplified Reporting: Eliminating the complexities of tip reporting would reduce administrative burden on both employees and employers, saving time and resources.

- Improved Compliance: A simpler system may lead to better compliance, reducing the incidence of underreporting and ensuring greater fairness.

- Economic Stimulus: Increased disposable income for service workers could stimulate local economies, leading to greater spending and economic growth.

Arguments Against:

- Revenue Loss for the Government: Eliminating tip taxation would lead to a significant loss of tax revenue for the government, potentially impacting public services and programs.

- Potential for Abuse: Concerns exist that eliminating tip taxation could lead to underreporting of income by both employees and employers, undermining the fairness of the system.

- Impact on Other Taxpayers: The loss of tax revenue might necessitate adjustments to other taxes or cuts to government spending, potentially impacting other taxpayers.

- Unintended Consequences: Changes to the tax system can have unintended consequences, impacting various sectors of the economy in unpredictable ways.

The Ongoing Debate and Future Implications

The debate surrounding the taxation of tips is far from over. The proposed Senate bills highlight the need for a balanced approach that considers the interests of both service industry workers and the government. The potential economic and social impacts of eliminating or significantly altering tip taxation are significant and require careful consideration.

Further research and analysis are essential to fully understand the potential consequences of different policy options. The debate will likely continue, involving various stakeholders, including economists, policymakers, and representatives from the service industry. The outcome will have long-term implications for millions of service workers and the overall tax system.

In conclusion, the question of whether to eliminate or modify the taxation of tips is multifaceted and complex. While the potential benefits for workers are undeniable, the potential costs to the government and other taxpayers need to be carefully weighed. The ongoing Senate debate underscores the urgent need for thorough and impartial examination of this issue before any significant changes are implemented.